Convertible Bonds Advantages and Disadvantages

Some of the common disadvantages associated with convertible debt have been mentioned below. Make Market Volatility Work to Your Advantage.

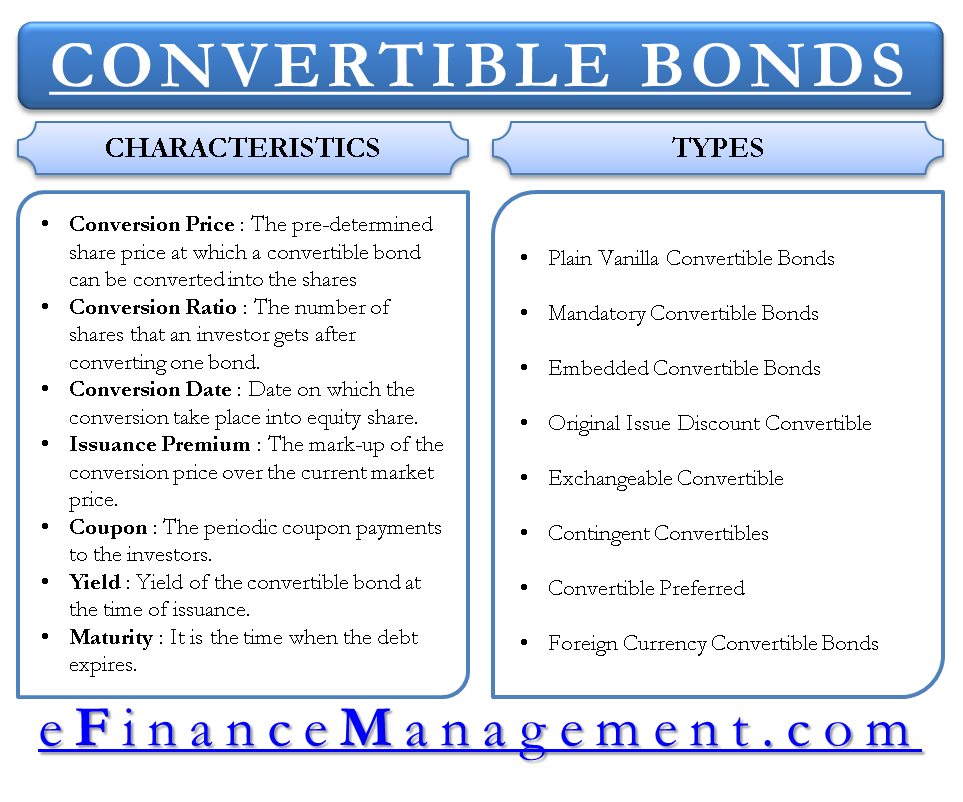

Convertible Bonds Primer On Conversion Features

Ad Learn why conservative investing might not be as safe and prudent as it sounds.

. Thus the company is required to pay interest to its creditor. Read customer reviews find best sellers. You may be surprised about what you read.

The few disadvantages which also accompany the advantages of convertible securities are listed below. Generally companies with strong credit ratings are more likely to repay convertible. Disadvantages of Convertible Securities.

A convertible bond with an. Ad Learn why conservative investing might not be as safe and prudent as it sounds. You may be surprised about what you read.

Convertible debentures may remain vulnerable to the issuing companys credit rating. Retirees beware of this conventional wisdom. Retirees beware of this conventional wisdom.

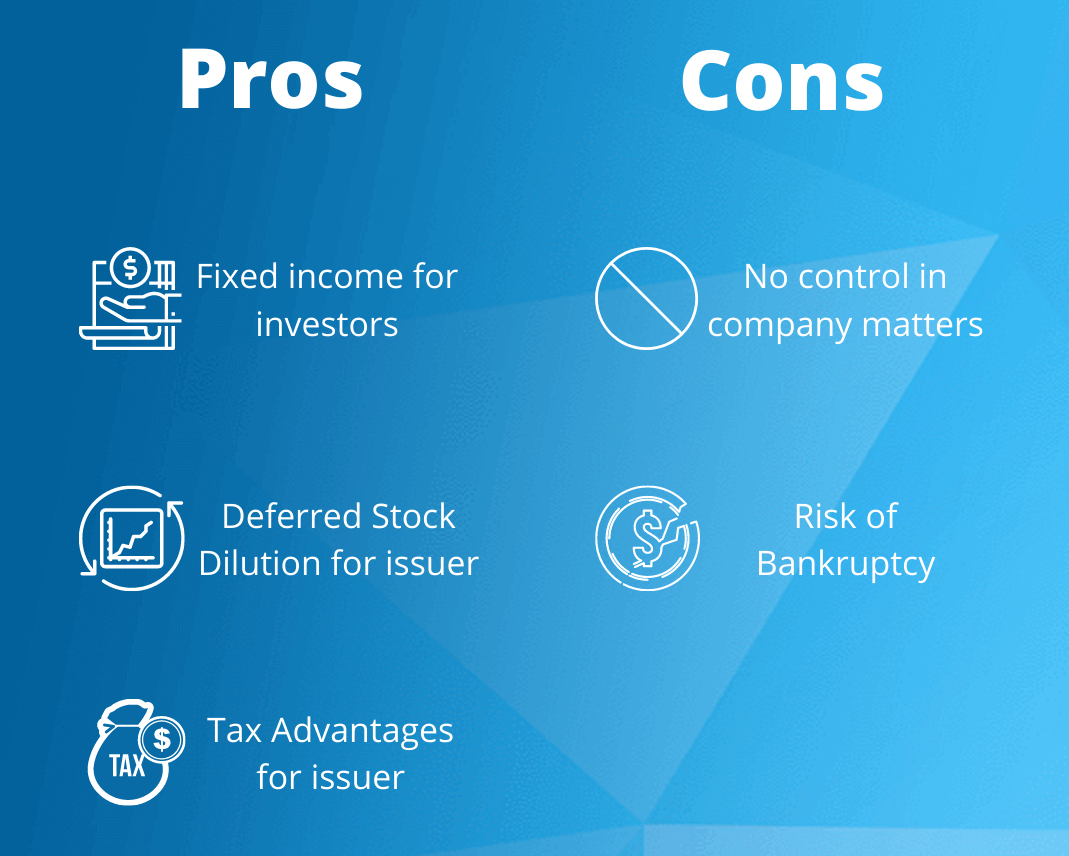

You can issue preferred stock shares with no voting rights to keep your lenders from having a. The main advantage of issuing convertible bonds for a borrowing company is that the cost of the loan will be lower than the straight issue of debt. The maturity of the reverse convertible bonds is very low are compared to regular bonds.

By issuing convertible debt instead of stock you remain the majority stockholder. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. EPS or Earning Per.

Convertible Bonds advantagesdisadvantages Lower Interest Rate - The benefit to the issuer of convertible bonds is that investors will accept a lower interest rate since there is potential. Other disadvantages mirror those of utilizing straight debt although convertible bonds do entail a greater risk of bankruptcy than preferred or common stocks and the. Learn About Stocks Bonds Futures and More.

A The value retained for the shares subsequently converted. Start Your Investing Education. If the normal bonds of Ensolvint were trading at 10 yields and the yield of the convertible was 10 bond investors would buy the bond and keep it at 100.

They provide asset protection because the value of the convertible bond will only fall to the value of the. The first and most obvious disadvantage of convertible debt is the. More risk of volatility of the market as more than one economy come into picture.

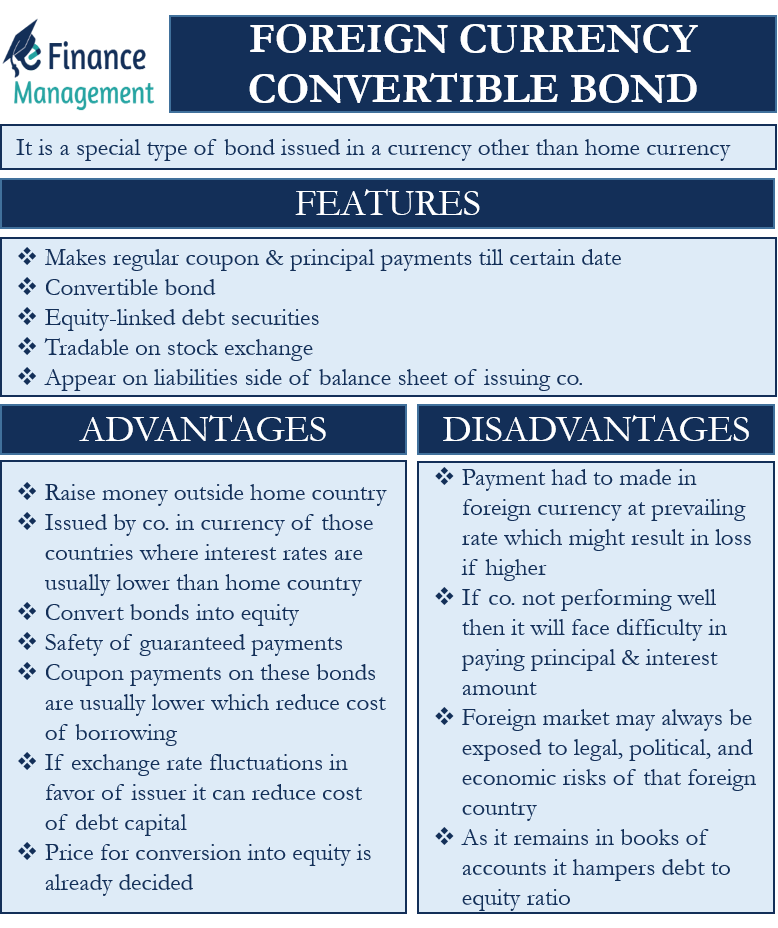

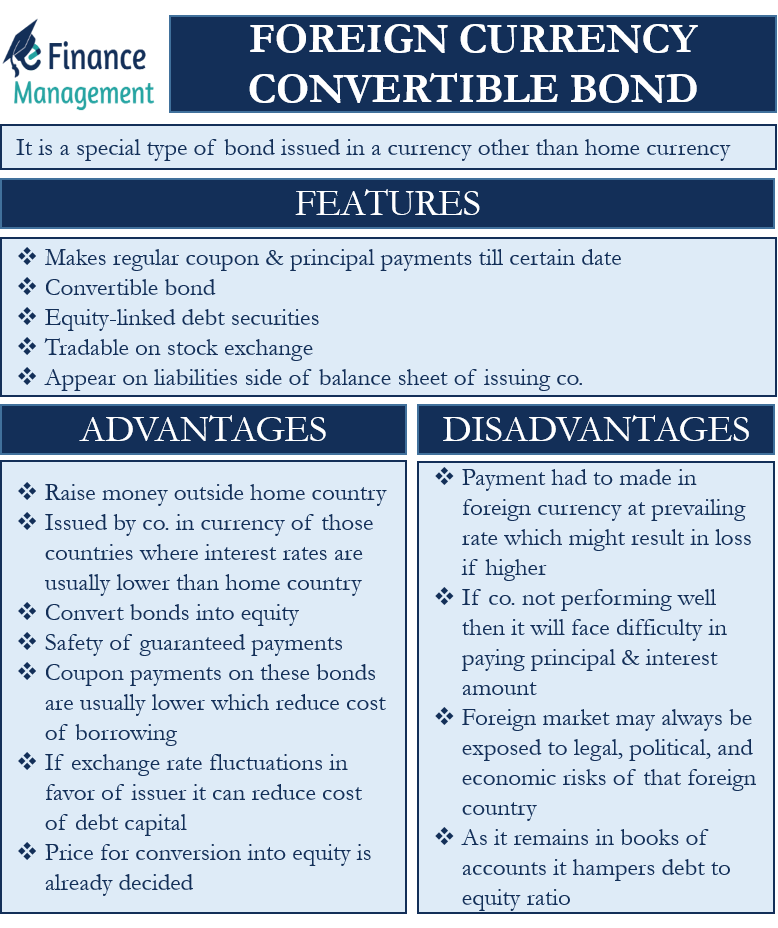

Disadvantages of foreign currency convertible bond. There is a risk of exchange as the interest is to be. The convertible bonds are usually issued by companies that are having problems raising a capital.

Browse discover thousands of brands. Ad Trade your view on equity volatility with Mini VIX futures. Convertible bonds are safer for the investor than preferred or common shares.

Convertible bonds work like a traditional loan. Most reverse convertible bonds are sold with maturities between three. The market for a convertible bond is less liquid hence the problem in understanding.

Convertible Bonds Efinancemanagement

Foreign Currency Convertible Bond Fccb

Convertible Bond Everything You Need To Know Eqvista

0 Response to "Convertible Bonds Advantages and Disadvantages"

Post a Comment